Many investors are excellent at looking at the big picture: purchase price, Net Operating Income (NOI), Cap Rate — perhaps even a few regional comps. But those who rely solely on these key metrics when purchasing real estate can easily be misled. Because the actual heart of every single property is hidden in a document that is underestimated by many: The Rent Roll.

What many people overlook in this process: The Rent Roll does not show what was actually paid – but rather what tenants are contractually obligated to pay. It represents the agreed-upon rents, not those that were actually received.

That’s exactly what the T12 (Trailing Twelve Months Income Statement) is responsible for: It reflects the realized income from the last twelve months. Only when both documents are used together and analyzed in conjunction can the actual yield of a property be seriously assessed.

A real-world example

A 312-unit deal in a solid location in Tampa, with an asking price of 68 million dollars. According to the financial statements, $2,194 per apartment per month is stated, which means $8.215M per annum as Gross Potential Rent.

Everything appears to be consistent and in order. But a closer look at the Rent Roll reveals a very different picture:

- Monthly concessions (discounts) are given in the amount of $128,000, which reduces the actually agreed rent to $1,784 per apartment or by $410.

- Seven tenants have payment arrears.

- Notably, a large portion of the lease agreements expire in March. This concentration of lease expirations harbors risks and should be staggered – because if many units become vacant simultaneously, the risk of vacancy and increased leasing pressure rises significantly.

On paper, the property appears highly profitable and stable – in reality, however, it is vulnerable and at risk. This is precisely where sound underwriting separates itself from superficial hope and wishful thinking.

What is a Rent Roll - and Why is it So Important?

The Rent Roll is much more than just a listing of the current tenants. It is the operating system of the property. It shows:

- Which units are currently rented out

- Which unit represents which specific floor plan type

- How large the respective individual units are

- How the unit mix is distributed — for example, according to the number of bedrooms (1BR, 2BR, 3BR)

- How high the agreed rent is for each unit

- How long the individual contracts run and when they originally began

- Which rental arrears currently exist

- How high the agreed security deposit is for each tenant

- And whether the income is actually being collected

The Rent Roll also provides insight into additional income streams that influence the net result: such as separate fees for pets (dog rent), water charges, waste disposal (trash pick-up), garage or parking space rentals. Precisely these line items are often not presented transparently or correctly in property exposés — but can collectively make the difference between whether a property is cash-flow stable or only running on a shoestring budget.

A properly prepared Rent Roll allows you to look beneath the surface — and to assess whether the property is actually healthy or just appears to look good on the surface.

Eight Key Questions to Assess a Rent Roll Properly

1. Do the Rent Roll and T12 align with each other?

When the rental income shown in the Rent Roll deviates from the figures stated in the T12 (Trailing 12-Month Income Statement), this is a clear warning signal – and it is no coincidence. This can be attributed to a number of factors: Market rents that are too high are listed, which are “balanced out” through a “Loss to Lease” — meaning the difference between the actual contractual rent and a theoretically higher market rent.

It’s designed to imply returns that exceed what the property can realistically deliver. Also, one-time payments such as fees for early contract termination can artificially inflate the T12. A deviation between Rent Roll and T12 must therefore always be carefully investigated. It is not a technical error, but usually an indication of operational weaknesses or financial manipulation.

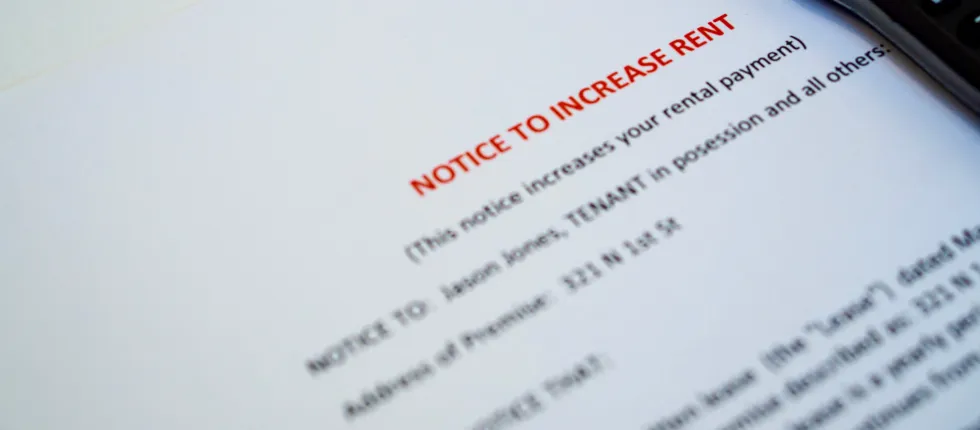

2. Is there a concentration risk with the contract terms?

A high concentration of lease expirations in a single month can create operational risk: Even with slightly declining demand, sudden vacancy can occur in multiple units simultaneously.

A lease rollover cluster poses a clear risk: it makes short-term income unpredictable and puts pressure on management to re-lease multiple units at once. Just as risky is a scenario where many leases default to month-to-month terms because the landlord failed to renew them.

This allows tenants to terminate their leases with just 30 days’ notice. If, say, 30% of the units fall under this category, key loan covenants could suddenly be at risk.

3. How stable is the tenant base?

A short average tenant tenure or unusually high turnover is typically a sign of underlying issues. The causes can vary: Rents may be set above market, prompting residents to leave at the first opportunity. Quality of life also matters — poor maintenance, unreliable service, or unfavorable neighborhood dynamics discourage long-term stays.

For investors, an unstable tenant base means more than just higher administrative overhead and re-leasing costs. It also increases the risk of vacancies and volatile cash flows. And then there are the often-overlooked turnover costs: every move-out triggers expenses — repainting, flooring, cleaning, even unit measurement. Especially with high turnover, these so-called make-ready costs add up quickly and erode operating margins — even though they don’t show up in the Rent Roll.

That’s why high-turnover properties always require closer scrutiny.

4. Which other payments are recorded, are these consistent or not? Do the figures for other payments match the information in the T12?

In addition to the base rent, many properties generate additional income — for example, through pet fees, garage or parking space rentals, waste removal charges, water usage surcharges, or income from on-site laundry facilities.

One-time or recurring charges such as application fees, administrative fees, and key or access card charges also contribute to this category.

These ancillary revenues may represent only a small portion of the total income, but when applied consistently, they can meaningfully enhance net operating cash flow.

Another key consideration is who bears responsibility for operating costs — including water, wastewater, trash removal, and electricity. In many U.S. markets, especially in the Sun Belt, RUBS (Ratio Utility Billing Systems) are commonly used. These systems allocate utility costs proportionally to tenants, reducing property-level expenses and improving net yields — assuming the charges are implemented consistently and properly reflected in the Rent Roll.

That makes it essential to verify consistency: Are these charges recurring or one-time? Are they applied uniformly across units? Are there anomalies, exemptions, or inconsistencies?

Most importantly: Do the amounts shown in the Rent Roll align with the figures reported in the T12?

The income stream can only be assessed reliably if these figures are consistent, transparent, and clearly documented. Any discrepancies should be closely examined — they may point to ambiguous lease terms, inflated one-time charges, or unsustainable ancillary income.

5. How are new rentals developing?

One of the clearest indicators of a property’s market position is how it performs on new leases. If a recently vacated unit is re-leased at a higher rent, it suggests strong demand, a compelling property, and solid pricing power for the owner.

By contrast, when concessions are required — such as free rent, covered utilities, or reduced deposits — it’s a sign the asset may be under pressure, whether due to new competition, structural shortcomings, or softening demand in the submarket.

For investors, it’s not enough to know the average rent — what matters is the context: under what terms was that rent achieved, and are those conditions sustainable?

6. Do existing tenants renew their leases — and at what price?

enant renewal behavior provides a clear gauge of a property’s attractiveness and overall stability. When tenants are willing to accept higher rents upon renewal (Trade-up), it reflects a healthy price-performance ratio, competent property management, and a strong surrounding location.

If rents remain unchanged or increase moderately during renewal, that too is a solid and healthy indicator.

The picture changes, however, if tenants only agree to stay under reduced terms (Trade-down). This may signal insufficient willingness to pay, growing competitive pressure, or deteriorating quality of living conditions.

Typical retention rates for stabilized properties range between 50% and 60%.

For investors, this makes one thing clear: Lease renewals are a central early warning system — and an often overlooked indicator of a property’s real condition.

7. Are there arrears or constant delays?

A unit may appear “occupied” on the Rent Roll — but that alone doesn’t reflect whether rent is actually being paid. In practice, it’s not uncommon to see tenants fall behind on payments, pay late, or default entirely.

It’s equally important to assess whether outstanding balances are ultimately written off. For investors, this means projected cash flow may never materialize.

The situation becomes more concerning when delinquencies cluster — for example, within specific buildings, tenant segments, or as a result of weak screening practices.

Patterns like partial payments, chronic delays, or pending evictions should raise immediate red flags.

Occupancy alone doesn’t guarantee income. What matters is economic occupancy — the share of units that are actually generating rent payments.

A physical occupancy of 95% may appear healthy at first glance, but it means little if 10% of tenants are chronically delinquent.

That gap can serve as a leading indicator of deeper operational issues.

8. How high are the security deposits?

Security deposit levels are a frequently overlooked indicator of tenant screening quality.

Very low — or entirely waived — deposits often signal overly lax approval processes. In many cases, the aim is to speed up leasing by reducing friction, but this can backfire: leading to higher default risk, greater unit damage, and costly eviction proceedings.

It’s especially concerning when deposits are formally agreed to — but only partially paid, or when tenants put down merely symbolic amounts. In these cases, close scrutiny is essential.

Increasingly, owners turn to deposit insurance solutions — such as surety bonds — as an alternative to traditional cash deposits. This approach can be sensible, as it often provides greater coverage.

For investors, the key question remains: Whether cash or insurance — what matters is that a real, enforceable protection mechanism is in place. If not, financial exposure increases significantly when issues arise.

Common Pitfalls — and What They Really Cost

We consistently see the same blind spots in rental income reviews. Rents listed in the Rent Roll are often taken at face value — without verifying whether they’re actually being collected or simply agreed on paper.

Lease terms and notice periods are similarly overlooked, which can lead to serious disruptions — for instance, when multiple leases expire at once, triggering vacancy risk.

Rent concessions — such as temporary discounts or move-in incentives — are also frequently omitted or misrecorded, resulting in a distorted picture of actual cash flow.

A critical — and often neglected — step is to conduct an independent rent comparison study.

A professional rent comp study goes far beyond scanning online listings.

It evaluates signed lease agreements from comparable properties, considers market dynamics over time, tracks socioeconomic shifts in the micro-location, and assesses the asset’s competitive positioning.

Especially in markets with aggressive concessions or high development volume, this level of analysis is essential — because list prices say little about what tenants are actually willing to pay.

This comparison is key to determining whether current rents are truly sustainable.

Without this level of analysis, it’s impossible to know whether new leases reflect true market conditions — or if units were rented under pressure, well below market value.

Just as concerning: projected rent increases that have no basis in local fundamentals. In such cases, entire underwriting models rest on assumptions disconnected from reality.

Finally — and most often neglected: cross-checking with bank statements or actual rent ledgers. These documents are essential to verify whether the reported cash flow truly materializes.

The cost of overlooking these fundamentals? Investors end up paying for a return that exists only in the spreadsheet — not in real life.

Our Approach — and Why It Matters

In our due diligence process, the Rent Roll is non-negotiable.

It is not just a table of figures — it is the diagnostic core of any property’s financial health.

Our approach follows a clear, three-step structure:

First: We cross-reference the Rent Roll with the T12, the bank statements, and the accounts receivable. A rent figure on paper means little unless it is reflected in actual cash flow. What matters is not what a tenant should pay — but what they do pay. Is it timely? Complete? Consistent? Only this triangulation reveals the property’s true earning power.

Second: We analyze the timing structure of the leases. Not just the current status, but its trajectory. When do contracts expire? Are there clusters that may trigger vacancies? Which cancellation periods apply? Are renewals structured or random? We don’t wait for volatility to show up in the cash flow — we anticipate it.

Third: We assess new leases in the context of the local market. Are current rents supported by demand — or do they depend on incentives like rent-free months or reduced deposits? A property that requires giveaways to fill units is not a stable income source. Our question is simple: Is this sustainable demand — or temporary patchwork?

This methodology is rigorous. It demands data, transparency, and local insight. But it protects us — and our investors — from false assumptions, inflated projections, and structural misjudgments.

Our Conclusion:

A good Rent Roll is no guarantee for a successful investment — but it’s a prerequisite.It doesn’t make a property safe by itself. But it tells you whether the foundation is solid.

Because only when the reported income is actually being collected, when lease structures are stable, and no hidden risks lie beneath the surface — only then can a property’s yield potential be assessed with confidence.

The reverse is also true: A poor Rent Roll is never just a technicality. It signals inaccuracy, lack of oversight, or operational strain — and should raise immediate red flags.

At the same time, it also reveals potential: High turnover, under-market rents, inconsistent cash flow — these are not dead ends, but starting points for improvement. Professionalized management, restructured leases, or a clear repositioning strategy can unlock value — if the challenges are acknowledged and priced accordingly.

This isn’t financial engineering. It’s clarity.

Those who understand the Rent Roll not as a formality but as a strategic instrument gain foresight — and control.

Especially in a market where brochures shine and investment stories often sound too good to be true, the Rent Roll is the one document that doesn’t exaggerate.

It doesn’t show what’s promised — it shows what is.

We don't buy charts. We buy cash flow.

Because the nominal rent means little if the tenant doesn’t pay – or moves out after six months. What matters is not just the number, but the quality, consistency, and resilience of the income stream.