Investors in real estate seek more than buzzwords—they look for three essentials: value appreciation, ongoing cash flow, and long-term security. A property should deliver returns today while growing in value tomorrow. This requires regions that expand, create income, and ensure stable rents over time.

Florida provides precisely this environment. The state has long been one of the most economically vibrant regions in the USA. Each year, over 350,000 people net migrate here, companies expand, and new jobs emerge—particularly in technology, healthcare, financial services, and logistics.

The result is an economy whose gross domestic product now surpasses that of Saudi Arabia. At its heart: Tampa Bay, one of Florida’s most balanced and dynamic submarkets.

Why Tampa?

The Tampa–St. Petersburg–Clearwater MSA—the full metropolitan area, not just the city—has been one of the Sunbelt’s most stable growth hubs for years. According to Yahoo Finance, Tampa was ranked the second-best U.S. location for full-time employment in 2024 as the second-best U.S. location for full-time employment.

The region also excels academically: The University of South Florida ranks among the top ten universities for STEM fields—a reliable indicator of future innovation and talent influx.

In Tampa, the economy isn’t tied to a single sector. If tech falters, healthcare thrives. If construction costs rise, finance grows. This balance is no coincidence—it’s the outcome of decades of forward-thinking location policy.

The real economy shows continued momentum. Insurer GEICO is building a campus with over 1,000 jobs, Sysco Foods is expanding its distribution center by another 300 positions, and the tech sector aims to create around 3,700 new roles in FinTech, HealthTech, and Cybersecurity by 2027.1

This development is no accident—it reflects the Sunbelt’s shift from industrial to knowledge-based economy.

Compared to other Sunbelt markets, Tampa proves particularly resilient. While Austin or Phoenix saw rent declines of up to six percent in 2024, prices in Tampa remained nearly stable.

The average cap rate for Class-B multifamily properties stands at about 5.4 percent—a solid ratio of yield to risk in a market still poised for growth.

Meanwhile, the cityscape is transforming. The billion-dollar Water Street project is reshaping downtown with housing, green spaces, and workplaces within walking distance. With the ONE Tampa high-rise—42 stories, 225 luxury apartments starting at around one million dollars—a new skyline landmark will emerge by 2026.2

Such projects demonstrate confidence in the market’s sustainability and symbolize development driven not by interest rates, but by structure.

All together, this paints a picture that could hardly be more pragmatic: Tampa Bay is no hype—it’s craftsmanship.

No hype: Tampa Bay isn’t a short-term attention market like Austin, Miami, or Phoenix, driven by social media trends, tech booms, or speculation. Capital often flows there before fundamentals can support it.

Craftsmanship, on the other hand, stands for a market that works because robust, repeatable mechanisms are at play—jobs, migration, income, planning, construction, demand.

It’s no game of expectations, but a labor market with cash flow and structure: solid, verifiable, rationally manageable. A market with substance, supported by immigration, employment, and structural clarity.

Those who prefer data over chance will find here what real estate investments rarely offer: growth with predictability.

Demographics and Influx

The Tampa–St. Petersburg–Clearwater metropolitan area (MSA) currently has around 3.4 million residents—and continues to grow. Since 2010, over 700,000 new inhabitants have arrived, representing a growth of about 17 percent. This makes the region one of the fastest-growing urban areas in the United States. This expansion is no coincidence: It is driven by expanding companies and people seeking better living conditions—fiscally, climatically, and professionally.

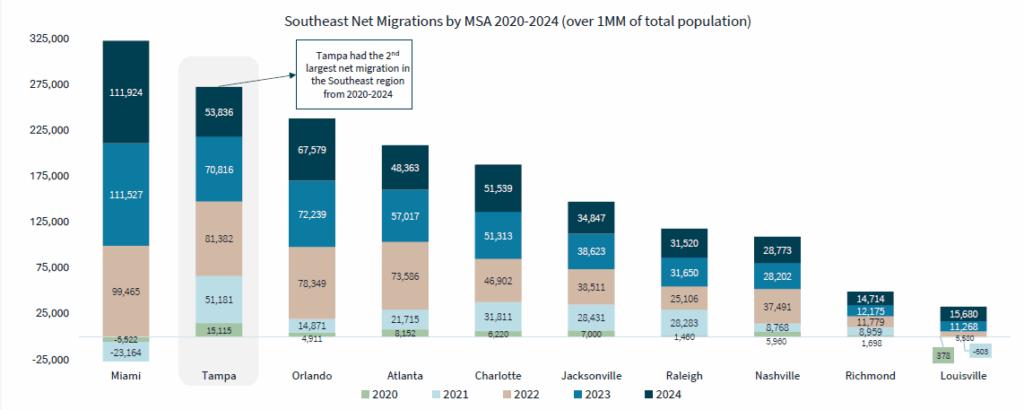

In 2024 alone, according to the U.S. Census Bureau, 53,836 new residents moved to the Tampa Bay area. Between 2020 and 2024, over 272,000 immigrants arrived—equivalent to nearly the population of Stuttgart. Among the fifty largest U.S. metropolitan areas, Tampa ranks 8th in annual influx and 5th over four years. In the southeastern U.S., Tampa holds the second spot behind Orlando.

Domestic migration is particularly notable: According to the U-Haul Migration Index 2024, Tampa is among the twelve most popular destinations for moves within the United States. While markets like Phoenix or Austin are cooling off, Tampa remains stable—people come not to speculate, but to stay. This creates steady demand pressure on the housing market and predictable rental yields.

The population structure also speaks to sustainability. The share of 25- to 44-year-olds—the classic renter group—exceeds the U.S. average. At the same time, the region attracts many retirees who bring purchasing power but prefer flexible living. This demographic balance between workers and retirees results in a housing market less dependent on economic cycles than in many other Sunbelt cities.

In summary, a market with natural demand pull emerges. Every new settlement, campus, and corporate relocation brings people, income, and housing needs. For investors, this means growth through real migration—not marketing hype.

Economy and Employment

The economic strength of the Tampa Bay region now approaches nearly 200 billion U.S. dollars. The area is one of Florida’s most powerful economic hubs and one of the few whose structure rests on more than two pillars. Financial services, medical technology, healthcare, tourism, and logistics interlink here.

In recent years, technology sector jobs grew by nearly 30 percent. Major employers like Raymond James Financial, Jabil, Bristol Myers Squibb, Citi, Pfizer, or Progressive Insurance invest consistently in the location. In 2024 alone, over 40,000 new jobs emerged in the MSA—the highest growth rate in over a decade. The unemployment rate remains steady at 3.5 percent, well below the national average.

Tampa benefits from a business-friendly climate: low taxes, high quality of life, short decision paths in administration and permitting. This makes capital productive faster. For investors, this creates an environment where economic growth isn’t abstract but translates into real rental yields and stable occupancy rates.

Housing Demand

Housing demand in Tampa Bay remains high—across all property classes. In the first half of 2025, over 8,000 apartments were newly leased—more than ever before. This represents an increase of nearly 15 percent from the previous year. According to JLL Research, Tampa ranked 15th among all U.S. markets for new leases and in the top 20 for occupancy rates.

The vacancy rate stands at around 7 percent, slightly above the historical low but still below the national average. In an environment of rising financing costs, this is remarkable: While other Sunbelt markets struggle with oversupply, Tampa maintains balance. Ongoing construction is largely absorbed because influx and job growth continually renew demand.

For investors, this means stable returns from a market that’s neither overheated nor stagnant. Tampa Bay demonstrates that sustainable demand isn’t chance—it’s the result of migration, employment, and location logic.

Rent Development and Income

The average asking rent in the region is around 1,980 dollars per month. Tampa Bay thus operates at a stable level, unmarked by overheating or price pressure. In a market driven by steady influx and growing employment, this is noteworthy: Rent increases here are not erratic but traceable—supported by income, not speculation.

As wages and household incomes in the region rise simultaneously, further rent growth remains likely. The median income currently stands at around 74,000 dollars and has grown above the national average for years. The rent-to-income ratio thus stays in a healthy range—a key indicator of sustainability, especially in a market focused on long-term holdings rather than short-term value gains.

New Construction and Pipeline

Currently, over 11,000 new residential units are under construction in the Tampa MSA. At the same time, the annual net absorption—the number of units actually taken up by the market—is about 6,000. This ratio shows that supply remains manageable relative to influx. The balance between new construction and growth is even: Enough is built to meet demand—but not so much as to create vacancies or rent pressure.

Average construction times are around two years—the projects currently underway thus cover about two years of typical housing needs. In other words: What is planned or started today will hit the market no earlier than 2027—at a time when population growth is expected to have brought another 100,000 people to the region.

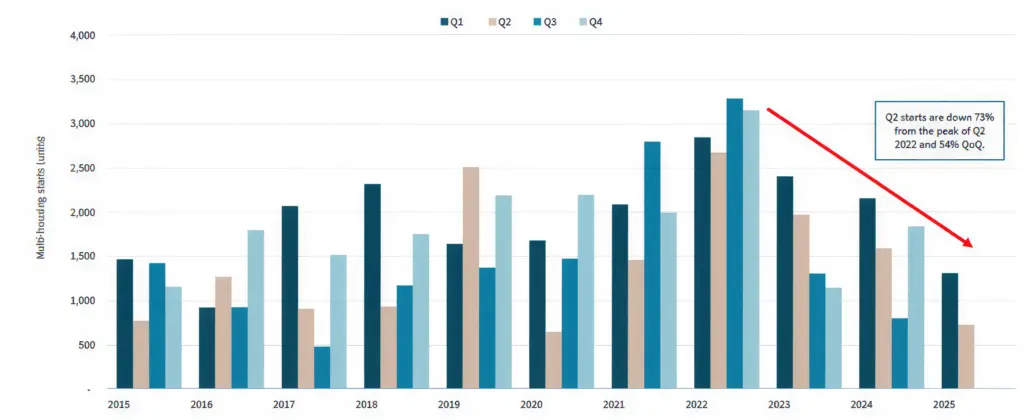

In recent quarters, however, the number of new projects has noticeably declined. Nationwide, the U.S. Census Bureau recorded around 359,000 multifamily housing starts in the first quarter of 2025—a modest increase from the previous quarter, but with a clear downward trend for future projects. For the first quarter of 2026, a level of around 366,000 units is expected, compared to 408,000 the previous year. In May 2025, the number of started projects was already nearly 30 percent lower than the previous year—a clear signal of cooling construction activity.

Tampa shows a nearly identical picture: 10,456 new units started in 2022, 9,281 in 2023, 6,733 in 2024, and just 5,256 in 2025. Behind these numbers is no drop in demand, but simple reality: rising construction costs, higher debt interest, and stricter financing conditions. Many developers postpone or cancel projects that would have been viable at lower rates.

In the medium term, supply tightens as a result. The apartments now being built will create additional space but hardly cover the demand generated by migration and job growth. For investors, this is a scenario rarely seen with such clarity: rising demand with restrained supply development.

Tampa Bay thus indirectly benefits from the same interest rate movements that brake other markets. Construction remains present but controlled—an environment where rents and prices react not volatilely but grow steadily. In the first half of 2025, the number of construction starts was 63 percent below the 2022 peak and 46 percent below the previous year—figures reflecting the new reality of more selective but healthier project development.

Infrastructure and Quality of Life

Parallel to construction, the region invests heavily in infrastructure and quality of life. Downtown Tampa is being comprehensively redesigned as part of the billion-dollar Water Street project—with a clear focus: more housing, more recreational quality, more urban living. Green spaces, pedestrian zones, and stronger mixed-use shall enliven the city center permanently and make it a magnet for talent and companies.

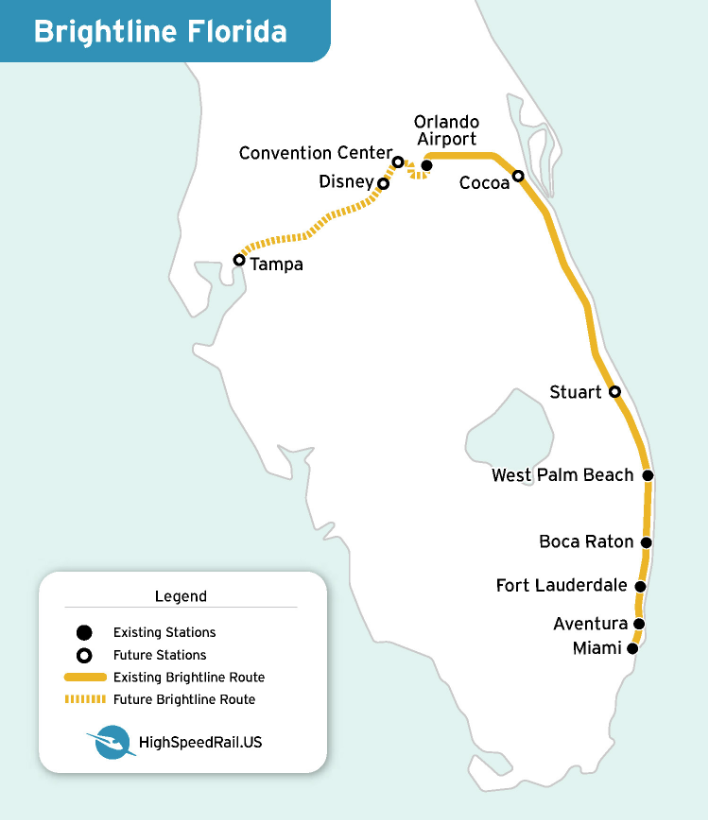

Additionally, interregional connectivity is expanding. The planned high-speed rail line from Miami via Orlando to Tampa creates a fast link between the state’s key economic centers. Tampa International Airport (TPA) is also being expanded—with new terminals, logistics areas, and improved international capacities.

These measures are more than urban beautification. They strengthen the region’s economic resilience and create the conditions for sustainable growth—with better mobility, higher location quality, and long-term stable frameworks for residents and investors alike.

Taxes and Framework Conditions

Florida levies no income tax. The corporate tax rate, at 5.5 percent, is also well below the U.S. average. For investors, this creates an environment where returns aren’t eroded by high taxes but remain in the project.

Moreover, Florida has long been one of the most business-friendly states in the USA. There is no state-level capital gains tax, no inheritance or estate tax, and numerous incentive programs that facilitate business startups and expansions. Property taxes remain moderate compared to many other metropolitan areas.

Particularly noteworthy is the administrative efficiency: Companies can be founded online within days—a process that can take weeks in other states. Approval procedures are streamlined, regulatory density and bureaucracy low. For investors, this means: Projects can be implemented faster, capital deployed more efficiently, and returns realized sooner.

These framework conditions directly impact the real estate sector. Developers and owners benefit from a tax-favorable structure, while investors can build on stable net returns.

Especially compared to high-tax states like California or New York, where local levies consume a significant portion of yields, Florida offers a clear location advantage. For international investors, this tax difference is often the decisive factor in site selection.

Comparison with Other Markets

Tampa Bay is among the most dynamic Sunbelt markets in the United States. While growth in other regions like Austin or Atlanta has recently slowed, it remains broadly based and supported by multiple pillars here.

The Urban Land Institute (ULI), in cooperation with PwC, ranks the region in the top 4 U.S. markets in the Emerging Trends in Real Estate 2025 report7—a clear endorsement. Particularly noteworthy: Tampa made the biggest leap year-over-year among all Florida metros and now counts among the most promising emerging locations in the country.

International analyses confirm this picture. Goldman Sachs’ research department recommends targeted investments in Sunbelt markets like Tampa amid global uncertainty, rating their labor markets and housing demand as more resilient and less interest-sensitive than in many coastal states.8

In summary, Tampa Bay exemplifies what investors seek: economic breadth, calculable growth, and a regulatory environment that enables capital rather than hinders it.

Perspective and Value Appreciation

Property prices in the Tampa MSA continue to rise—more moderately than in boom years, but on a solid foundation. For the multifamily sector, short-term fluctuations aren’t decisive; fundamentals are: population growth, job density, construction activity, and rents.

Since 2010, the region has gained over 700,000 new residents—a clear double-digit increase, making Tampa one of the fastest-growing metropolitan areas in the USA. In 2023 alone, the growth rate was 2.03 percent, placing it 4th among all major U.S. metros. The labor market remains stable: over 1.7 million employed, an unemployment rate of around 3.1 percent, and continuous job gains create a demand base that sustains the housing market long-term.

Price movements in single-family homes have limited relevance in this context. The multifamily sector follows its own mechanisms—shaped by rent development, absorption rates, and financing conditions. In Tampa, this combination ensures stability: solid rents, high occupancy rates, and a controlled new construction pipeline.

This creates a market in Tampa with long-term value appreciation potential, defined less by speculation than by structure—a market that delivers because it works.