Anyone investing in multifamily properties in the United States quickly encounters a key metric: the Cap Rate, short for Capitalization Rate. It is one of the most important tools for assessing how a property performs in day-to-day operations – independent of financing, leverage, or tax effects.

While in Germany investors often rely on gross yield figures that may look attractive on paper but rarely reflect operational reality, the Cap Rate offers a more honest view of a property’s actual income potential.

What exactly does the Cap Rate measure?

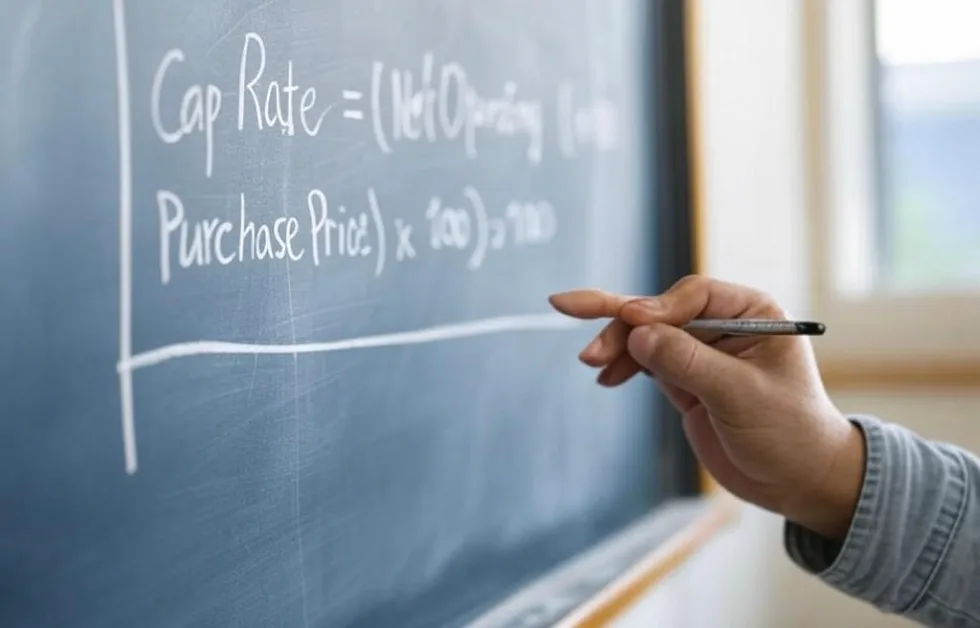

The Cap Rate indicates how much of the purchase price is earned back each year through the property’s net operating income (NOI). In other words, it reflects the operating return on capital – calculated before interest, taxes, or debt service.

Formula:

- NOI: Net Operating Income, i.e., annual revenue from operations (gross rent minus operating expenses).

- Purchase Price: The actual price paid for the property.

Step by step to the Cap Rate: How it is calculated

Based on the actual operating data of a 134-unit apartment complex, we illustrate how the Cap Rate (Capitalization Rate) is typically calculated in the U.S. — a key performance metric for real estate investors.

Revenue Overview

Category | Amount | Notes |

|---|---|---|

Gross Potential Rent (GPR) | $2,182,593 | Based on market rents |

Economic Loss | –$81,294 | Vacancy, concessions |

Net Rental Income | $2,101,299 | |

Other Income | $325,636 | Internet, pet rent, services |

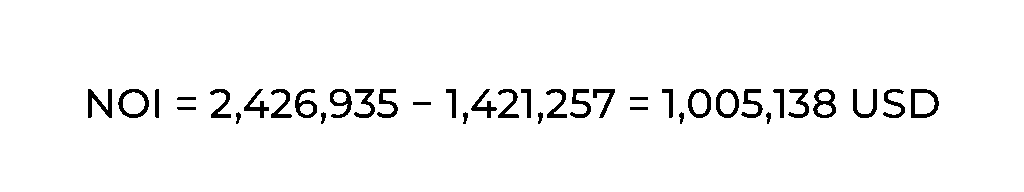

Effective Gross Income (EGI) | $2,426,935 |

Operating Expenses (Opex)

Category | Amount | Per Unit / Notes |

|---|---|---|

Repairs & Maintenance | –$176,950 | $1,301 per unit |

Payroll | –$219,855 | $1,617 per unit |

Marketing & Admin | –$115,229 | $856 per unit |

Utilities | –$280,654 | $2,064 per unit |

Property Management | –$72,808 | 3% of EGI |

Insurance | –$338,740 | $2,491 per unit |

Property Tax | –$217,021 | $1,596 per unit |

Total Operating Expenses | –$1,421,257 |

Result

Assuming a purchase price of $16,850,000, this results in:

- The Cap Rate of 5.97 % is above the current interest rate levels for many U.S. financing options (approx. 5.25–5.75 %).

- The positive spread between Cap Rate and interest allows for a positive cash flow, even with moderate leverage.

- This setup remains economically viable for professional investors, especially in growth markets with rental upside and potential for value appreciation.

Why is the Cap Rate so essential?

Cap Rate is more than a formula – it plays a central role in strategic investment decisions:

- Property Valuation: A realistic price can be derived directly from the expected operating income.

- Comparability: Investors can compare different properties – even across cities or markets – using a standardized measure.

- Financing Strategy: When the Cap Rate exceeds the cost of debt, positive leverage becomes possible. When it does not, investors may face equity gaps or need value appreciation to justify the investment.

The strength of scale: What larger assets offer

When investing in large multifamily properties, several advantages quickly become apparent:

- Economies of scale: Operating costs such as administration, insurance, and third-party services decrease on a per-unit basis.

- Professional management pays off: These assets are typically operated by dedicated management companies – efficient structures lead to better performance.

- Leverage through financing: Thanks to higher cap rates, investors can secure favorable financing terms and achieve attractive returns on equity.

- Flexibility in rent adjustments: In many U.S. states, annual rent increases to market level are permitted – this allows net operating income (NOI) to grow over time while costs remain stable.

- Scalable exit strategies: Large multifamily properties appeal to institutional buyers, enabling exits through portfolio sales or acquisitions by REITs. At the same time, the asset class remains sufficiently liquid even in weaker market phases.

What is a 'good' Cap Rate?

There is no universal benchmark – Cap Rates vary depending on the market and risk profile:

Cap Rate Range | Description |

|---|---|

4–5% | Prime locations, new construction, high stability |

5–6.5% | A/B locations with balanced risk–return profile |

Above 6.5% | Lower-grade assets or tertiary markets with higher volatility |

Cap Rate and Market Trends

The Cap Rate is not a static metric – it fluctuates in response to broader economic developments. Changes in interest rates, inflation expectations, and capital availability all influence yield requirements and, ultimately, valuation levels. For instance, during periods of rising interest rates, Cap Rates tend to increase as investors demand higher returns for capital deployment. Conversely, in low-interest environments, compression of Cap Rates is common, particularly in core markets.

It is therefore essential to analyze Cap Rates within the current macroeconomic context, especially when planning acquisitions or pricing exit scenarios.

Cap Rate in Context: Comparing Valuation Metrics

While the Cap Rate is widely used for its simplicity, it represents only a snapshot of a property’s performance – based solely on current income and price. To gain a more comprehensive view, professional investors often complement it with other metrics:

- Internal Rate of Return (IRR): Captures the total return of an investment over time, including future cash flows and exit value.

- Cash-on-Cash Return: Focuses on the return on actual equity invested, making it highly relevant for leveraged deals.

Using these metrics in combination allows for better risk assessment and strategic alignment across investment horizons.

Conclusion

The Cap Rate is a fundamental metric for evaluating U.S. multifamily investments – straightforward in structure, but powerful in application. It provides what many other indicators fail to deliver: a reliable picture of a property’s operating performance, independent of financing or tax structuring.

Compared to the heavily regulated and often low-yield residential market in Germany, many U.S. regions continue to offer investors an appealing combination of operational cash flow, scalability, and long-term value appreciation – provided the fundamentals are sound.