ADDRESS | UNITS | FLOOR SPACE |

|---|---|---|

PURCHASE DATE | SALE DATE | PURCHASE PRICE | SALE PRICE | REALIZED RETURN |

|---|---|---|---|---|

Past performance and statements regarding earnings are no guarantee of future results.

Realized return

Units | |

Floor Space | |

Purchase Date | |

Sale Date | |

Purchase price | |

Sale Price | |

Realized Return |

Why we invested

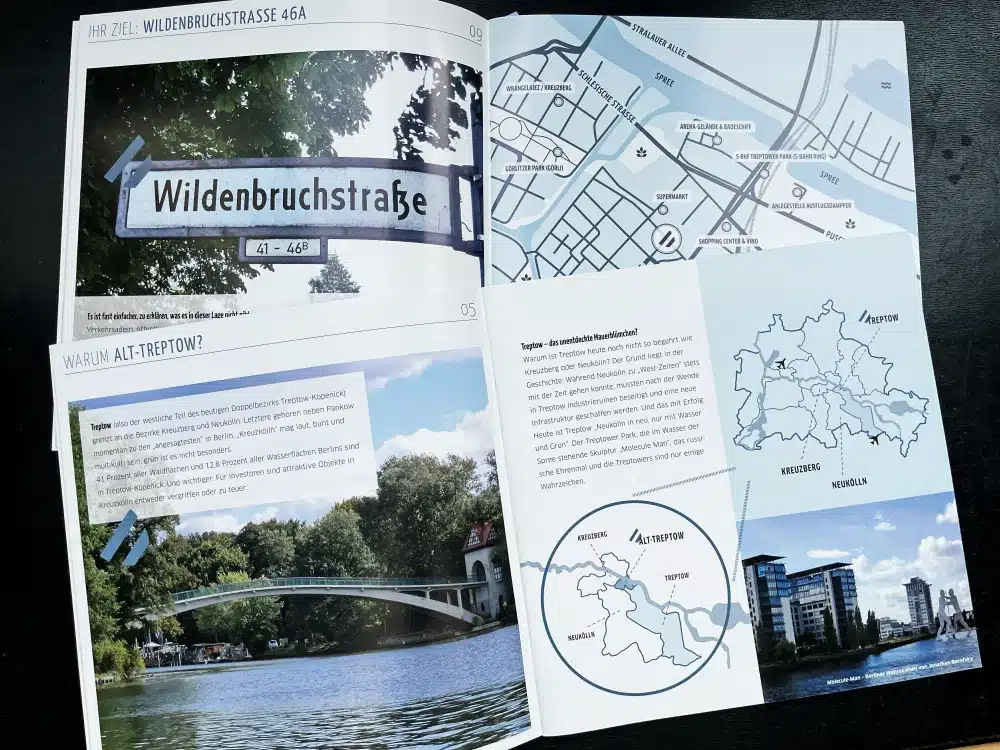

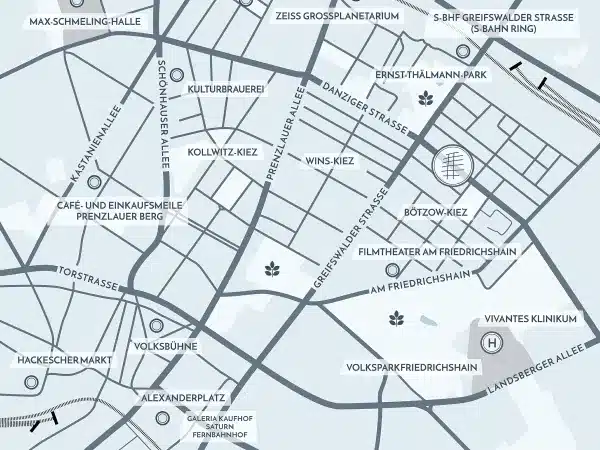

Located in the verdant northern region of Berlin, Hermsdorf offers a perfect blend of urban flair and natural serenity. With its superb infrastructure, diverse leisure opportunities, and charming town center, this neighborhood has evolved into a coveted residential locale.

Enclosed by the prestigious Frohnau and the continuously expanding Glienicke, the growth of this borough is nothing short of inevitable.

In 2004, this certainty was not as pronounced when the property at Hohefeldstraße 58 was presented to us. At that time, while many investors were financing price escalations in districts like Prenzlauer Berg, we recognized the potential of a location that was not yet on everyone’s radar.

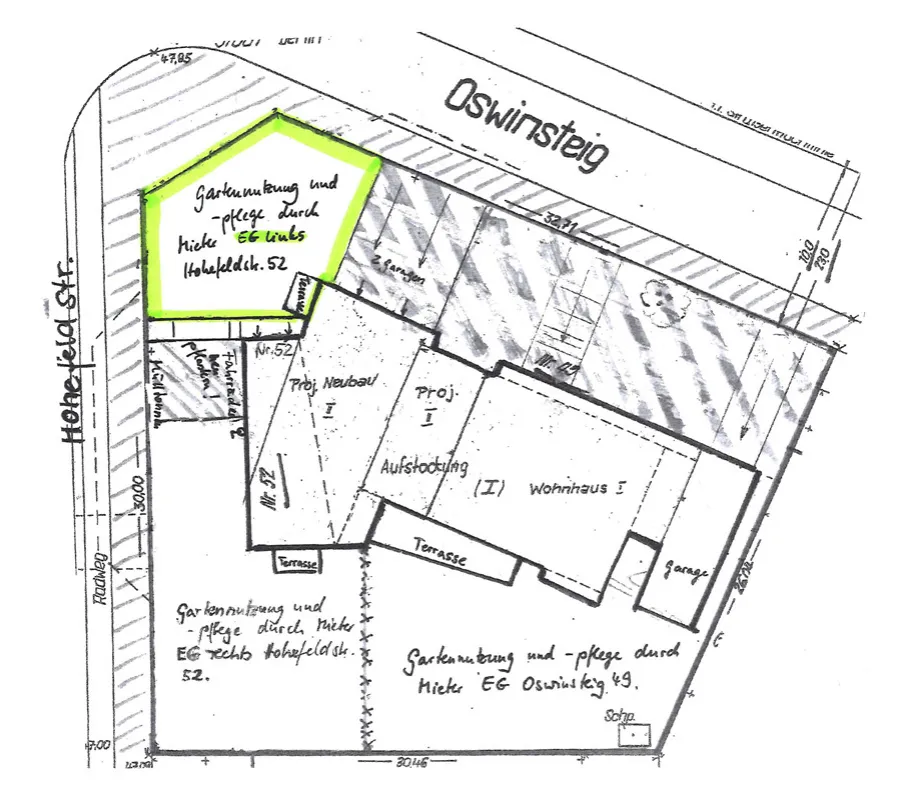

We were aware that we would find undervalued properties in this (still) emotionally neutral setting – such as the one on the corner of Hohefeldstraße and Oswinsteig, just a few steps from the picturesque Waldsee lake.

This investment was conceived less as a speculative venture and more as a long-term holding property.

Opportunities and Challenges

- Due to suboptimal management (nowadays almost a prerequisite for Whitestone properties), our initial task was to establish a positive relationship with tenants who understood that our investment necessitated adjustments in rental rates.

- Thanks to the financing conditions at the time, it was possible to secure 100% financing, entirely covered by rental income.

- Nevertheless, it was foreseeable that reinvestments would be necessary in the future, both in the property itself and within the apartments, in order to justify higher rental rates.

Results

We were able to finance both the property itself and the necessary investments in the subsequent years entirely through external capital, making it nearly impossible to calculate a return on equity.

Within three years, we successfully raised previously neglected rents by almost one hundred percent, thus ensuring sustainable refinancing.

To convey a strong message to the tenants, we promptly dispatched a craftsman to the property on the very day the purchase agreement was signed. The purpose of this immediate action was to have the aging fence freshly painted prior to our first on-site visit.

This proactive measure aimed to demonstrate our commitment to the tenants and their well-being. Our efforts were met with positive responses.

In friendly cooperation with the tenants, we were able to steadily improve both the standard of the property and the rental rates over the years.

Eventually, after nearly 15 years, we possessed an asset that had appreciated in value by more than fourfold.

Continuing our activities as Whitestone Capital in the USA led to the sale of the property at the end of 2018.

This project, too, inspired us to implement our strategy and methods in different market conditions. We were confident that we would achieve even greater success within the legal, jurisdictional, and political framework of the United States.

Today, we know that our confidence was well-founded.

Nonetheless, we shall never forget our humble roots in Hohefeldstraße, which gave us the confidence for our great leap forward.