ADDRESS | PURCHASE DATE | SALE DATE | AVG. RENT AT PURCHASE |

|---|---|---|---|

2150 62nd Terrace S, St. Petersburg | 06/2024 | ca. 08/29 | $1,378 |

AVG. RENT AT SALE | RENT INCREASE | NOI | IRR REALIZED |

|---|---|---|---|

$1,800 (EST) | N/A | N/A | N/A |

Past performance and statements regarding earnings are no guarantee of future results.

At a glance

2150 62nd Terrace S, St. Petersburg | |

|---|---|

Purchase Date | 06/2024 |

Sale Date | ca. 08/29 |

Avg. rent at purchase | $1,378 |

Avg. rent at sale | $1,800 (EST) |

Rent increase | N/A |

NOI | N/A |

IRR realized | N/A |

Why we invested

2024 – Adapting Investment Strategies

As market conditions evolve, so too must our investment strategies. Since 2022, interest rates have risen significantly, prompting us to reassess and refine our approach to remain successful in a challenging market environment.

“Villas at Flagler Pointe”

The “Villas at Flagler Pointe” in South St. Petersburg exemplifies how our speed, determination, and a touch of good fortune consistently help us uncover valuable opportunities.

Attractive Location and Market Dynamics

St. Petersburg and its surrounding areas are experiencing steady population growth, driven by the area’s appeal to both young professionals and retirees, as well as the general influx of new residents to Florida.

This growth results in sustained demand for rental properties, especially in well-positioned neighborhoods like Greater Pinellas Point.

Proximity to key economic and leisure areas, coupled with ongoing urbanization, supports the stability and potential appreciation of rental prices.

The location in South St. Petersburg is particularly advantageous. Within 10 minutes by car, one can reach the beaches of St. Petersburg, renowned for their scenic views and recreational opportunities.

The Central Avenue Corridor, known for its diverse dining, shopping, and cultural events, is also a short drive away. Additionally, Fort De Soto Park, a popular destination for nature and outdoor enthusiasts, is approximately 15 minutes away and offers extensive beaches and numerous hiking and biking trails.

The nearby Interstate 275 provides convenient access to downtown Tampa with its constantly growing variety in job opportunities, the Skyway Marina District, and other central business areas, enhancing the location’s appeal and providing tenants with great mobility.

Greater Pinellas Point offers easy access to all attractive jobs in the area within a reasonable commute.

Property Details

The 1972-built residential complex, featuring 136 units and spanning approximately 107,048 rentable square feet, was available for purchase due to the former owner’s need for liquidity. Despite multiple attempts, the sale was unsuccessful due to financing challenges faced by interested parties.

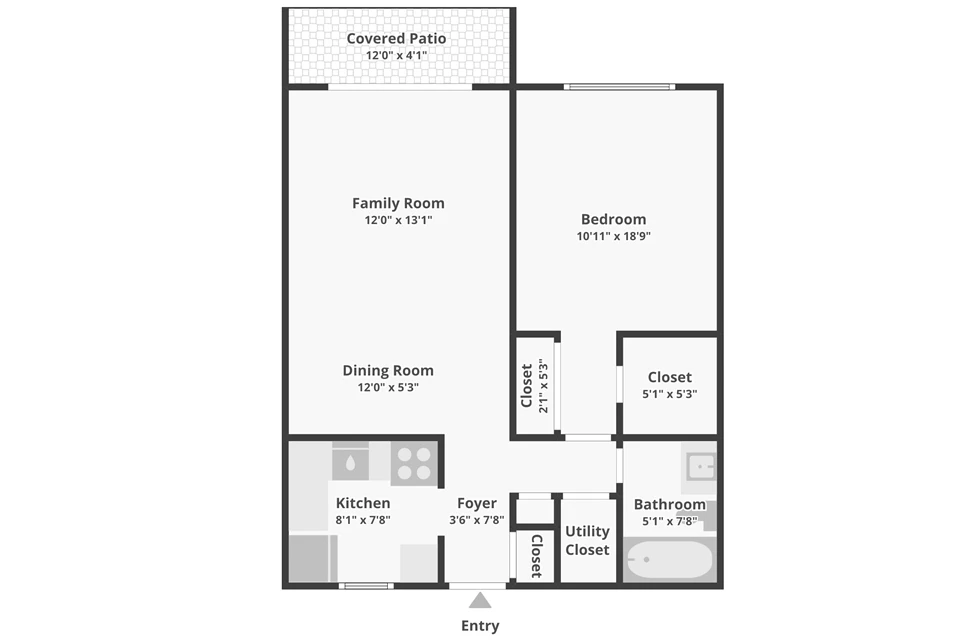

The property comprises 76 one-bedroom apartments and 60 two-bedroom apartments, with an average size of 787 square feet and a current occupancy rate of 95%. This size and rental rate align perfectly with market needs and tenant budgets.

Initially, the property was marketed to larger, more established investors who made offers above our expectations. After these attempts failed, the broker recommended Whitestone Capital, emphasizing the need for a quick, well-financed, and reliable partner.

This recommendation led us to secure the property at approximately one million USD below the seller’s asking price, gaining a significant advantage through this off-market deal.

Challenges and Opportunities

- The unexpectedly favorable acquisition price is key to achieving significant value appreciation in the coming years. It is unprecedented for a Whitestone project to acquire a well-leased, profitable asset with minimal immediate management needs or crisis interventions.

- The Freddie Mac agency financing over five years provides a currently attractive and fixed interest rate of 5,8%. We successfully secured sufficient investors to reduce the Loan-to-Value (LTV) ratio to 55%, starting with a solid capital base. This lower LTV offers several advantages:

- Protection of invested capital from market fluctuations, providing a secure foundation for long-term growth.

- Full interest-only financing over five years, increasing cash returns by deferring principal payments.

- Strengthened income streams and reduced risk during the holding period.

- Elimination of the need for additional financing in case of unforeseen expenses.

- Improved lender terms due to lower leverage.

- This financing enables us to distribute a recurring cash yield every quarter, starting after just two quarters. Initially, this yield will be approximately 5% p.a. and is projected to increase to around 10% p.a. according to our business plan.

This strategy presents a robust investment opportunity that combines stability, income security, and long-term growth potential.

Planned Improvements

The planned upgrades include:

- Installation of ceiling fans in all bedrooms

- Conversion to LED flat panels in kitchens, hallways, and living rooms

- Replacement of all doors and hardware

- Addition of washer and dryer connections and equipment in all two-bedroom units

- Installation of tiled backsplashes in the kitchens.

- Updates to electrical and plumbing fixtures as needed

Exterior improvements will involve:

- Fresh exterior paint for the buildings

- Attractive landscaping redesign

- New signage, wayfinding systems, and rebranding

- Expanded exterior lighting

- Roof renovation, including the installation of insulation.

- Replacement of damaged wall coverings

- Enhancements to the clubhouse, fitness center, and laundry room

A budget of 1.1 million USD has been allocated for these improvements. Upon completion, we anticipate a property value increase of approximately 4.7 million USD.

Interior ceiling collapse and insulation debris following roof failure

Exposed roof structure following storm-related material loss

Fallen tree obstructing primary walkway access to building

Roofing crews applying new TPO membrane to restore waterproofing and structural integrity

Operational Update – Hurricane Milton Impact

On October 9, 2024, Hurricane Milton made landfall on Florida’s west coast, causing relevant damage across the Tampa Bay region. Atlas at Bay Point was significantly impacted, but we are grateful that all residents and staff remained safe.

In advance of the storm, we activated our Emergency Response & Hurricane Protocol, which included securing loose items, boarding up facilities, notifying residents of evacuation zones, and pre-coordinating with emergency contractors and insurance adjusters. Thanks to these preparations, we were able to respond quickly once the storm passed.

Emergency Preparedness Efforts

Damage Assessment

- Notified residents about storm forecasts and evacuation zones.

- Secured trash bins, pool furniture, and outdoor equipment.

- Boarded up the leasing office and critical areas.

- Cleared storm drains and trimmed trees.

- Pre-alerted insurance brokers, carriers, and adjusters.

- Arranged roofing contractors and emergency responders to be on standby.

- Closed the leasing office in a timely manner to ensure staff and resident safety.

These efforts minimized the risk to tenants and set the stage for a faster recovery.

- Multiple fallen trees, including one large tree leaning against a building.

- Extensive roof damage; drone inspections revealed three buildings with major roofing loss.

- Debris scattered across the property.

- Interior damage rendered at least 10 units immediately uninhabitable.

Insurance and Recovery Strategy

We have submitted a complete Business Loss Income Insurance claim covering operational disruptions through March 31st. Advance payments from our insurance carrier are expected shortly, ensuring continuity during the recovery phase. Our team is working closely with the public adjuster’s CPA to document lost rental income, repair costs, utilities, and associated expenses.

Insurance coverage is expected to compensate for lost rents up to 92% occupancy for up to two years, providing strong financial protection during the rebuilding process.

Leasing and Occupancy Performance

- 224 leasing inquiries were received in March.

- 94% occupancy was maintained on available units.

- 3 lease renewals completed in March, with a 7.1% rent increase annualized.

- In-place rents have grown 4.2% since acquisition, exceeding projections.

Our AI leasing assistant, “Lisa”, has further streamlined leasing efforts, handling tenant inquiries and scheduling tours effectively, maintaining strong lead conversion despite adverse conditions.

Capital Improvement Opportunity

While the hurricane damage is unfortunate, it presents a unique opportunity for property enhancement:

- Replacement of multiple roofs will strengthen the asset’s long-term value.

- Several affected units were already scheduled for renovation; insurance-supported repairs will allow for more efficient upgrades.

- Exterior work will include repainting and landscaping to boost curb appeal.

This reconstruction phase will allow Atlas at Bay Point to emerge stronger, safer, and even more attractive to tenants.

Recovery in Action

Reconstruction is already underway:

- Roofers have secured all critical sections.

- Interior remediation teams are operating on-site.

- Cleanup and stabilization efforts continue daily.

Commitment to Investors

We will continue to provide weekly updates as recovery progresses. Thanks to robust insurance coverage and disciplined asset management, Atlas at Bay Point remains well positioned for full stabilization. We are confident that these efforts will lead not only to full restoration, but to an even stronger asset for the long term.

Results to Date

Initial Project Steps

Since acquiring the property in June/July 2024, we have been in the early stages of familiarizing ourselves with the project. One of the first steps we took was establishing the new name and launching a corresponding website.

This creates a solid foundation for branding and communication with prospective tenants and stakeholders.

Model Unit

Additionally, we immediately renovated, furnished, and designed a model unit as a prototype for the future renovations of all units.

This show apartment allows prospective tenants to get a tangible sense of the quality of the finishes, the layout, and the overall living experience. By creating an emotional connection, we help visitors envision themselves living in the space while offering suggestions for optimal room utilization.

Looking Ahead with Confidence

We are now looking forward to the next five years with both enthusiasm and calm determination. This project holds special significance for us as it demonstrates that Whitestone Capital has matured: we are surrounded by well-capitalized investors who trust in our capabilities.

We can apply the skills we have honed over nearly a decade in an environment free from the pressures of urgency.

Commitment to Long-Term Success

Our focus remains on what defines Whitestone Capital—measured professionalism and the execution of long-term, forward-thinking strategies.

We approach the project with confidence, knowing that our calm and calculated approach will deliver sustained value over time.

We will keep you posted

We will continue to keep you informed as we progress through this exciting project!