For a long time, New York was the dream of every real estate investor. Those who bought there did not just purchase walls, roofs, and square meters – they bought a myth. In hardly any other city was it so self-evident: real estate is concrete gold, it carries you through crises, recessions and financial market shocks. Anyone who owned an apartment building in Manhattan could sleep soundly at night.

Today, this myth is being put to the test. The push by politician Zohran Mamdani to introduce a comprehensive rent freeze in New York makes it clear that what was once considered safe can be politically devalued within a few years.

New York’s housing market, once the model of stability, is becoming a lesson in the power of populist intervention. But the reality is more brutal: since the Housing Stability and Tenant Protection Act (HSTPA) of 2019, the values of rent-stabilized buildings in New York have deteriorated dramatically – a silent disaster that is costing investors billions and driving the city into a spiral of decay and capital flight.

According to a study by the University Neighborhood Housing Program, median prices for rent-stabilized units have plummeted from $290,000 to just $122,000, a drop of over 57 percent in just a few years1.

The political drumbeat: Mamdani and his draft law

On February 2, 2024, Zohran Mamdani presented his Good Cause and Good Repairs bill. The content is quickly summarized:

- Regulated rents may only increase if the apartment is in “good condition”.

- What “good condition” means is not defined by the market, but by politics – a vague formulation that leads to endless disputes and bureaucratic hurdles.

- Over one million apartments would be affected, essentially all buildings with more than six units built before 1974.

This would mean that a third of the city’s entire rental housing stock would be subject to a de facto price freeze. Anyone who delays repairs automatically freezes their income. Those who repair have no guarantee that they will be able to refinance.

It is a model that does not create incentives, but forces owners into a dilemma: do they lose out on the revenue side or the cost side – or both at the same time?

By August 2025, Mamdani, now a Democratic candidate for mayor, has made this bill a central campaign issue, including a comprehensive rent freeze for two million stabilized renters2.

A Milstein Center analysis shows that about 39 percent of regulated apartments would fall under this rent freeze because they have not undergone significant repairs in the past five years – the very units that low-income renters need most, but could now fall further into disrepair3.

A look back: The long history of rent regulation in New York

Rent regulation is not a new phenomenon in New York. Its roots go back to the 1940s, when price freezes were introduced after the Second World War to curb the housing shortage.

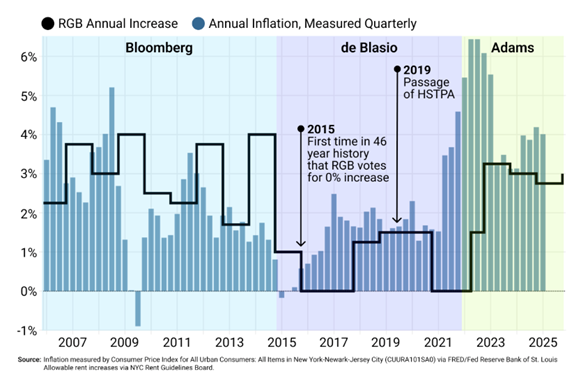

In the 1970s, with the founding of the Rent Guidelines Board (RGB), the system was given an institutional framework. The RGB is a city commission in New York City that decides annually on the allowable rent increases for rent-stabilized apartments – it is crucial because it directly influences the landlords’ income and thus controls the economic viability of the properties4.

For decades, the result was predictable: low but steady increases. Investors had found a model: Buy buildings, modernize individual apartments, deregulate step by step and realize the difference in value compared to free market rents.

This gave rise to an entire industry – from private equity firms to local owners. However, the HSTPA of 2019 destroyed this mechanism. Vacancy bonuses, modernization allowances (IAIs) and major rehabilitation allocations (MCIs) were massively restricted5. Owners thus lost the central tools with which they could make their investments economically viable.

Regulated rents are adjusted annually by the RGB – and this is now coming into focus as Democratic candidate Mamdani has announced plans to freeze regulated rents. The recent trend in rent increases compared to inflation provides a revealing context:

Since then, the market has resembled an airplane that is still in the air, but whose engines are being systematically shut down. Six years after HSTPA, owners report rising costs and falling values – delinquency rates (the rate of past due loan payments, i.e. how many loans are not being serviced on time) for regulated multifamily properties peaked at 16.43 percent in 2025, compared to under 1 percent for unregulated properties6.

This shows: Regulation does not create stability, but rather instability, which deters investors and causes the portfolio to age.

The hard math: when costs rise faster than rents

Real estate values in the USA follow a simple logic:

Value = Net Operating Income (NOI) / Capitalization Rate (Cap Rate).

NOI is the operating surplus of a property after all operating costs (property taxes, insurance, maintenance, management, utilities, etc.), before interest, taxes, depreciation and amortization.

The cap rate is the current return required by the market for the respective risk – expressed as a percentage (e.g. 5%).

This means that if the NOI falls, the value falls – with an unchanged cap rate of 1:1.

A practical example

- If running costs rise by 5 % annually, while regulated rents only increase by 2 %, NOI shrinks by around 3 % per year in real terms.

- Over ten years, this results in a decline in the NOI to around 74% of the initial level.

- With an unchanged cap rate of 5%, this corresponds to a reduction in value of around 26%.

- If the market yield (cap rate) increases by an additional 100 basis points (from 5 % to 6 %) over the same period, the calculated value falls to around 61 % of the initial value – a decrease of almost 39 %.

- In phases of rising interest rates and risk premiums, it is precisely this double twist (NOI down, cap rate up) that is the main driver of price slides.7

In the multifamily segment in the USA, there is no “apportionable net rent” as there is in Germany. Owners bear the main operating costs themselves – in particular property tax (often the largest single item), insurance, maintenance and some of the energy and management costs.

Although tenants pay a share of service charges (e.g. RUBS/condo metering), systematic cost transfers are regulated in the rent-stabilized portfolio.

So if rents are politically capped while insurance premiums, material and labor costs rise, inflation eats away at the NOI – and thus the value.

Important for lenders and refinancing: The DSCR (Debt Service Coverage Ratio) is directly dependent on the NOI. If the NOI falls by 15%, for example, an initial DSCR of 1.25× slips mathematically to ≈ 1.06× – below typical covenant thresholds (1.20-1.25×).

The result: cash sweeps, limited distributions, more difficult refinancing and, in the worst case, covenant default.

Empirically, the picture fits: RGB time series and market data show that real rents in stabilized units have lagged behind inflation for years – operating margins are shrinking and affordable providers are coming under pressure.8

Nationally, rental growth in 2024 was around 1.0%, with a record-high completion pipeline at the same time – a cyclical headwind that additionally affects regulated markets because price adjustments are politically capped there.9

The nationally weak growth is primarily due to supply waves in free markets; HSTPA & Co. are slowing down the income side in New York regardless of the new construction cycle – therefore the erosion of income in the regulated portfolio is structurally stronger.

Capped rents + rising opex = permanent NOI erosion. If cap rate expansion is added, the effect is multiplied. For investors, this is not theory, but the bottom line: value is cash flow. If you cap cash flow and let costs run, you destroy value – reliably, silently, in black and white.

The debt bomb: 105 billion dollars on fire

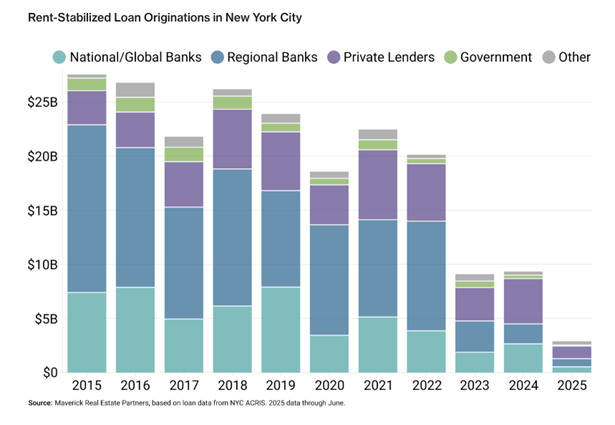

The dimension becomes visible when you look at the credit markets. According to the Milstein Center, USD 105 billion in loans are encumbering New York’s regulated portfolios10.

- Around 26,000 buildings serve as security.

- 21,000 loans are affected.

- Many of them come from regional banks, which hardly grant any new funds these days.

This does not include the so-called 421a properties – tax-subsidized new buildings that formally fall under stabilization but are treated separately by their own regulations.

The refinancing crisis is real. Loans that used to be on bank balance sheets for an average of three years now remain there for over five years. This blocks balance sheet headroom, prevents new lending and restricts the market.

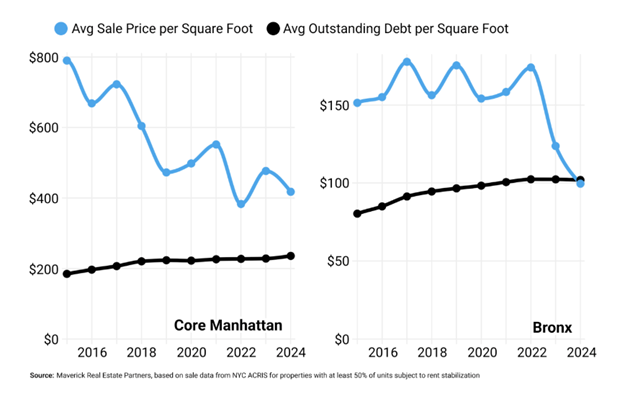

Particularly dramatic: in the Bronx, the average sales price per square foot has dropped to the level of the outstanding loan balance. This means that the equity has already been used up.

In practice, this means that many buildings are already mathematically insolvent. The level of debt corresponds to the market value – in some cases it is even higher. In such cases, owners effectively have no equity left, but only the choice between ‘hold and hope’ or selling at a loss.

The average sale price for 100 percent stabilized buildings in 2024 was $175,225 per unit citywide and only $112,023 in the Bronx – a clear indicator of the decline in value11.

Creeping expropriation through regulation

The real danger lies not in a sudden crash, but in silent erosion. A scenario that investors are examining:

- Four years of rent freeze.

- After that, two percent rental growth per year.

- At the same time, annual cost increases of five percent.

The result: after 16 to 17 years, the NOI is negative because income (rents) grows only slowly or not at all, while costs (e.g. due to inflation, maintenance and taxes) rise continuously – over time, expenses exceed income, which drives the operating profit into negative territory12.

The building loses its economic value. Not speculation, not an extreme case – but a sober forecast. Anyone still talking about a “stable asset class” here should explain how a property without operating income is supposed to retain its value.

The vacancy rate (the percentage of unrented units) for rent-stabilized units is only 0.98 percent (2023), compared to 1.84 percent for market rents – a sign of artificial scarcity that drives prices but blocks investment13. The HSTPA has led to a 14 per cent increase in retirements from stabilized inventory, while additions have increased by 370 per cent – but overall supply is falling14.

The "Default Rent Formula": a bureaucratic explosive device

There is also a legal minefield lurking: the default rent formula. If an owner cannot fully prove that an apartment has been legally deregulated, the “default formula” automatically applies: the rent is reset to the lowest level of comparable units in the building.

It’s a nightmare for banks and investors. Since 2023, the regulation also applies to lenders who take over properties after foreclosures. This means that even banks can fall into the trap – regardless of their own due diligence.

A property that seemed affordable yesterday can turn into a legal black box overnight. Studies show that rent control measures such as these reduce property values by up to 20 percent as potential income is capped15.

What is particularly tricky is that, since an amendment to the Rent Stabilization Code in 2023, this regulation also applies to lenders who take over properties as part of a foreclosure sale. This means that it is no longer sufficient to rely on average values in the neighborhood – complete documentation is required.

If documents are missing, the default formula automatically applies with all its financial consequences. For banks and investors, this significantly increases the risk of investing in the regulated portfolio.

Political rhetoric and economic reality

Zohran Mamdani presents his draft as protection for tenants and as a step towards greater social justice. But the economic reality speaks a different language:

- Investors are deterred.

- Banks withdraw.

- Renovations are not carried out.

- Apartments fall into disrepair.

The result: less quality, less new construction, less supply. The housing shortage problem is not solved, but exacerbated. Politically, however, it is still attractive:

A “New York rent freeze” sounds simple, quick and popular. In reality, it is a political placebo – expensive for investors, ineffective for tenants. In 2024, only 15,626 building permits were issued for new residential units, a decrease of 4.8 percent – a direct effect of such regulations16

International comparisons: Berlin and Florida

Berlin tried a similar experiment in 2020 with the rent cap. The consequences? Transactions fell by more than 50 percent, investments were halted and modernizations postponed.

In 2021, the Federal Constitutional Court declared the cap unconstitutional, but the damage was done: The Berlin real estate market was slow to recover and investors migrated to other markets17. According to a study by Humboldt University, the supply of rental apartments in Berlin fell by 15 percent during the rent cap, as landlords left the market or converted apartments into property18.

Florida shows the opposite: a market with clear, investor-friendly framework conditions. International funds are increasingly investing there today because the rules are predictable and the markets are fast-growing.

The US rental market is growing by 3.1 percent annually until 2030 – but is stagnating in regulated markets like New York, while Florida saw transaction growth of 12 percent in 202419.

Family Offices: Strategic implications

For family offices and institutional investors, the findings are clear:

- Capital flight: Those who can are pulling their money out of New York. Florida, Texas and Sunbelt markets benefit.

- Structural risk: Even conservative banks are avoiding the yield-stabilized market.

- Loss of image: New York loses its role as a “safe haven”.

For many family offices, which traditionally focus on stability, the message is clear: the market in New York is no longer a haven of security, but a politically mined area.

In Q2 2025, the NYC multifamily market showed only modest growth, with minimal transaction decline – but the trend is downward for stabilized buildings20.

Conclusion: From myth to illusion

New York was a global symbol of stability. Today, it is a symbol of how political intervention can destroy capital.

- Investment incentives are destroyed.

- Credit chains blocked.

- Owner disempowered.

- Markets unsettled.

The New York rent freeze is not an instrument of tenant protection, but a lesson in economic irrationality. It is a warning sign for investors worldwide: even the most prestigious markets can be turned into risky areas of speculation through political arbitrariness.

For investors, family offices and international funds, the sober realization remains: Here, substance no longer carries weight – only illusion remains.

Overall, HSTPA has led to a financial crisis in stabilized buildings, with falling values and rising distress rates (the rate of non-performing loans or properties that signal financial difficulties such as defaults or foreclosures)21.