Investing in commercial real estate—whether office buildings, retail spaces, industrial properties, or multifamily housing—offers significant potential for high returns. However, these opportunities come with substantial risks. This is where due diligence becomes crucial: a decisive evaluation process that can determine the success or failure of an investment.

What is Due Diligence?

Due diligence refers to the comprehensive assessment of the physical, financial, and legal aspects of a property prior to completing a purchase.

Its objective is to identify risks, confirm the property’s value, and ensure it aligns with the investor’s financial goals. Neglecting or rushing through due diligence can result in costly errors, making it an indispensable step in the investment process.

Financial Due Diligence: Examining the Numbers

- Reviewing Income and Expenses:

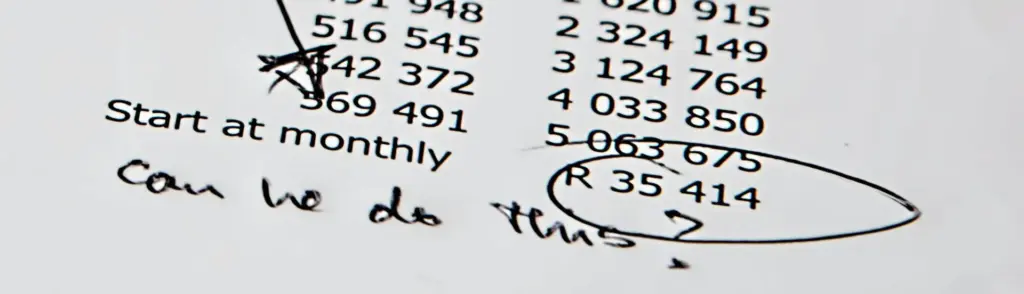

Analyzing rent rolls, lease agreements, and tenants’ payment histories helps evaluate the sustainability of income. Simultaneously, operational costs such as maintenance, management, and insurance should be scrutinized. - Cash Flow Analysis:

Metrics such as Net Operating Income (NOI), Capitalization Rate (Cap Rate), and Debt Service Coverage Ratio (DSCR) indicate whether the property is profitable and capable of meeting its debt obligations. - Market Comparison:

Comparable analyses of similar properties in the area provide insights into whether the purchase price is fair.

Legal Due Diligence: Securing Through Documentation

- Title Search and Ownership History:

A clear title search ensures that the property is free from legal encumbrances. - Zoning and Land Use Regulations:

It is crucial to confirm that the current and planned use of the property complies with local laws. - Lease Agreement Review:

Examining lease terms, tenant and landlord rights and obligations, and clauses with long-term implications on the property’s value is essential.

Physical Due Diligence: Assessing Property Condition

- Building Inspections:

Identifying and evaluating technical and structural issues, such as problems with the foundation, electrical systems, or HVAC units, is imperative. - Environmental Assessment:

A Phase I Environmental Assessment can uncover risks like soil contamination or asbestos. - Maintenance Needs and Future Investments:

Estimating future maintenance costs helps gauge the property’s economic viability.

Market Analysis: Understanding the Context

- Location Assessment:

Factors such as population growth, transportation links, and local economic development influence long-term profitability. - Market Trends:

Metrics like rental and vacancy rates, competing properties, and regional economic trends are critical. - Competitive Analysis:

Comparing similar properties sheds light on the competitiveness of the asset.

Consequences of Insufficient Due Diligence

Failing to conduct due diligence can lead to severe repercussions:

- Overpriced Acquisitions: An incomplete financial review can result in paying inflated prices.

- Unexpected Costs: Skipping inspections can lead to high repair and renovation expenses.

- Legal Issues: Omitting reviews of lease agreements or zoning regulations can trigger legal conflicts.

- Market Risks: A lack of market analysis may lead to investments in weak markets or overvalued assets.

Conclusion

Due diligence is not an optional process but the cornerstone of successful commercial real estate investments. Investors who meticulously examine all aspects of a property minimize risks, uncover opportunities, and make informed decisions that lead to long-term profitability. Engaging experts such as attorneys, appraisers, and inspectors ensures no detail is overlooked.

A successful real estate investor does not rely on luck but on thorough preparation and strategic analysis—this is the essence of due diligence.