I am often asked about the gross initial yield of the properties we acquire here or alternatively the multiplier (which is simply the inverse of the former metric), and I always respond: it’s completely irrelevant, as it’s in no way comparable.

Since these figures can’t be compared to the commonly used Cap Rate in the U.S., I’ll try to align these different approaches to yield calculations to make them more comparable.

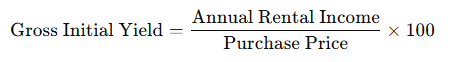

The (German) Gross Initial Yield

In the German real estate market, the gross initial yield is one of the key metrics, calculated as the ratio of annual (net cold) rents to the purchase price.

An Example from Berlin

Here, a property with an annual net cold rent of €100,000 is priced at €2,500,000:

Gross Initial Yield = (100,000 / 2,500,000) x 100 = 4%.

However, the investor still has to cover the operating costs out of this yield. Assuming a realistic size of approximately 1,200 m², this means the average rent is just under €7.00/m².

The owner must cover management costs, maintenance, and vacancy risk from the annual net cold rent.

Management is estimated at €35 per unit for an average size of 60 m² (€8,400 p.a.), vacancy risk at 4% (€4,000 p.a.), and maintenance at €20/m² (€24,000 p.a.). Any additional operating costs borne by the landlord are negligible.

This leaves the investor with €100,000 – €8,400 – €4,000 – €24,000 = €63,600 net income (before considering financing costs).

Taking into account the substantial acquisition costs in Germany (estimated at 12% in Berlin due to 6% land transfer tax and additional notary, registration, and brokerage fees), the “Cap Rate” for Berlin is:

63,600 / (2,500,000 * 1.12) = (63,600 / 2,800,000) x 100 = 2.27%.

Thus, the actual yield (assuming the investor pays in cash) is just over half of the gross initial yield.

The American Cap Rate

This is much more complex to calculate but provides a much more accurate view of a property’s profitability, independent of financing.

It calculates the ratio of net operating income (NOI) to the property’s purchase price.

Cap Rate Formula

The Cap Rate is calculated as follows:

NOI (Net Operating Income): annual rental income minus all operating and management expenses (but before financing costs and (profit) taxes). Unlike the German approach, the NOI calculation includes all costs associated with operating the property (e.g., management, personnel, maintenance, insurance, property taxes, vacancy, reserves, etc.), deducted from the contractual rent. The NOI to gross rent ratio, depending on the property, ranges from 40% to 60%, meaning NOI comprises between 40% and 60% of gross rent. This stems from the standard leases, which typically don’t allow tenants to reimburse operating costs in residential leases.

Example

Assume a property generates an NOI of $60,000 per year and has a market value of $1,000,000:

Cap Rate = $60,000 / 1,000,000 × 100 = 6.00%.

In this case, the Cap Rate is 6%, meaning the property generates an annual return of 6% of the purchase price (which is a reasonable figure in Florida markets at present).

Acquisition costs (unlike in gross initial yield) are not included in this calculation but amount to only around 1% to 2%.

In our example, the “real” Cap Rate would therefore be (assuming 2% acquisition costs):

Cap Rate = $60,000 / (1,000,000 * 1.02) x 100 = 5.88%.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Comparative Analysis

In my example, the German gross initial yield is 4%, with a resulting Cap Rate of 2.27%. The American Cap Rate (excluding acquisition costs) is 6%, with the adjusted Cap Rate at 5.88%.

Calculating the multipliers for the above values gives a multiplier for Berlin of 25 (excluding operating costs) and 34.72 including acquisition costs.

For the Florida Cap Rate, the multiplier would be 16.67, or 17.01 with acquisition costs.

Financing Conditions

As seen in the above examples, the yield on American properties is considerably higher than on German properties. But are they more profitable? Almost no one buys an investment property without financing, so financing conditions are a factor to consider.

In Germany, financing rates are currently around 3.5%.

In the U.S., financing rates are approximately 5.5%, which is significantly higher than in Germany.

The critical difference lies in the “spread,” meaning in Germany, financing rates are significantly above the “Cap Rate” (which isn’t truly calculated in Germany). This creates a negative leverage effect.

Leverage Effect

The leverage effect describes the ability to increase the return on equity for an investment by using debt (such as loans). This effect is particularly useful in real estate, as debt is typically cheaper than equity, which increases investment volume and can lead to higher potential returns.

However, this effect only works if the investment’s return exceeds the cost of debt (i.e., the financing rate). If the return is below the financing cost, the leverage effect turns negative, reducing the return on equity—known as negative leverage.

In recent years, this negative leverage effect has been evident across Germany’s real estate sector. This is why a return on equity is only achievable with a significant increase in income (politically discouraged and thus heavily regulated) or upon a later sale at a higher price. Under normal borrowing conditions (even with an LTV of only 60%), little to no return on equity is conceivable without these factors.

In the U.S., there is usually a spread between the Cap Rate and loan interest rates, meaning that even if no income increases are achieved (which are easier to realize legally in the U.S. than in Germany), a positive return on equity exists from the time of purchase.

Conclusion

The primary responsibility of investors is to thoroughly assess all risks associated with an investment and the corresponding potential returns. The return potential in the U.S., in all markets with a positive spread between Cap Rate and loan interest, is better than in average markets in Germany, without assuming market improvement.