Central Park at East Bay represents a return to fundamentals: solid structure, stable cash flow, and measurable potential. No speculation, no hype – a property that performs from day one and rewards disciplined asset management with sustainable value growth.

Continue readingAtlas at Bay Point

ADDRESS | PURCHASE DATE | SALE DATE | AVG. RENT AT PURCHASE |

|---|---|---|---|

AVG. RENT AT SALE | RENT INCREASE | NOI | IRR REALIZED |

|---|---|---|---|

Past performance and statements regarding earnings are no guarantee of future results.

At a glance

Purchase Date | |

Sale Date | |

Avg. rent at purchase | |

Avg. rent at sale | |

Rent increase | |

NOI | |

IRR realized |

Why we invested

2024 – Adapting Investment Strategies

As market conditions evolve, so too must our investment strategies. Since 2022, interest rates have risen significantly, prompting us to reassess and refine our approach to remain successful in a challenging market environment.

“Villas at Flagler Pointe”

The “Villas at Flagler Pointe” in South St. Petersburg exemplifies how our speed, determination, and a touch of good fortune consistently help us uncover valuable opportunities.

Attractive Location and Market Dynamics

St. Petersburg and its surrounding areas are experiencing steady population growth, driven by the area’s appeal to both young professionals and retirees, as well as the general influx of new residents to Florida.

This growth results in sustained demand for rental properties, especially in well-positioned neighborhoods like Greater Pinellas Point.

Proximity to key economic and leisure areas, coupled with ongoing urbanization, supports the stability and potential appreciation of rental prices.

The location in South St. Petersburg is particularly advantageous. Within 10 minutes by car, one can reach the beaches of St. Petersburg, renowned for their scenic views and recreational opportunities.

The Central Avenue Corridor, known for its diverse dining, shopping, and cultural events, is also a short drive away. Additionally, Fort De Soto Park, a popular destination for nature and outdoor enthusiasts, is approximately 15 minutes away and offers extensive beaches and numerous hiking and biking trails.

The nearby Interstate 275 provides convenient access to downtown Tampa with its constantly growing variety in job opportunities, the Skyway Marina District, and other central business areas, enhancing the location’s appeal and providing tenants with great mobility.

Greater Pinellas Point offers easy access to all attractive jobs in the area within a reasonable commute.

Property Details

The 1972-built residential complex, featuring 136 units and spanning approximately 107,048 rentable square feet, was available for purchase due to the former owner’s need for liquidity. Despite multiple attempts, the sale was unsuccessful due to financing challenges faced by interested parties.

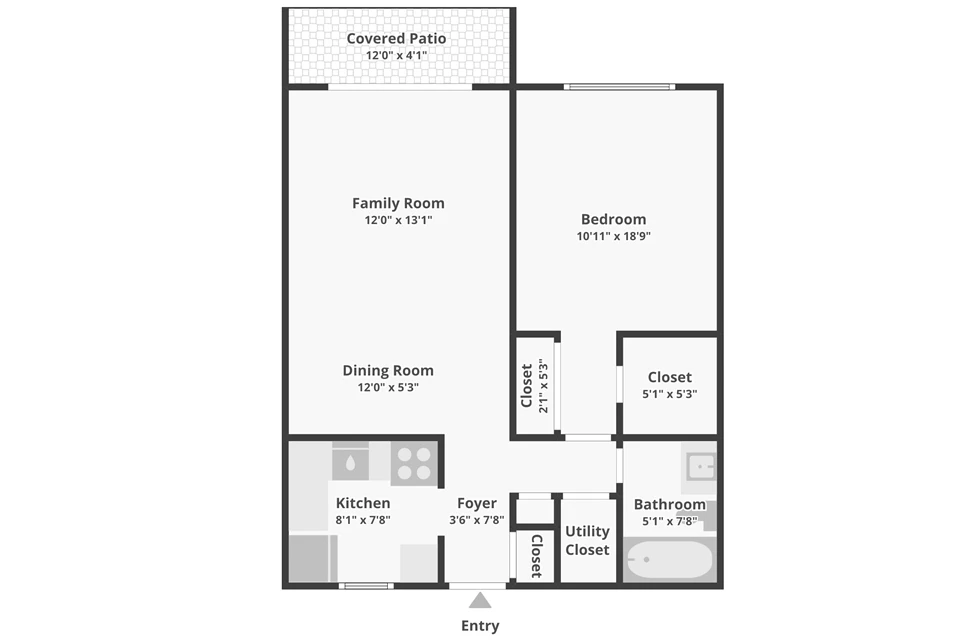

The property comprises 76 one-bedroom apartments and 60 two-bedroom apartments, with an average size of 787 square feet and a current occupancy rate of 95%. This size and rental rate align perfectly with market needs and tenant budgets.

Initially, the property was marketed to larger, more established investors who made offers above our expectations. After these attempts failed, the broker recommended Whitestone Capital, emphasizing the need for a quick, well-financed, and reliable partner.

This recommendation led us to secure the property at approximately one million USD below the seller’s asking price, gaining a significant advantage through this off-market deal.

Challenges and Opportunities

- The unexpectedly favorable acquisition price is key to achieving significant value appreciation in the coming years. It is unprecedented for a Whitestone project to acquire a well-leased, profitable asset with minimal immediate management needs or crisis interventions.

- The Freddie Mac agency financing over five years provides a currently attractive and fixed interest rate of 5,8%. We successfully secured sufficient investors to reduce the Loan-to-Value (LTV) ratio to 55%, starting with a solid capital base. This lower LTV offers several advantages:

- Protection of invested capital from market fluctuations, providing a secure foundation for long-term growth.

- Full interest-only financing over five years, increasing cash returns by deferring principal payments.

- Strengthened income streams and reduced risk during the holding period.

- Elimination of the need for additional financing in case of unforeseen expenses.

- Improved lender terms due to lower leverage.

- This financing enables us to distribute a recurring cash yield every quarter, starting after just two quarters. Initially, this yield will be approximately 5% p.a. and is projected to increase to around 10% p.a. according to our business plan.

This strategy presents a robust investment opportunity that combines stability, income security, and long-term growth potential.

Planned Improvements

The planned upgrades include:

- Installation of ceiling fans in all bedrooms

- Conversion to LED flat panels in kitchens, hallways, and living rooms

- Replacement of all doors and hardware

- Addition of washer and dryer connections and equipment in all two-bedroom units

- Installation of tiled backsplashes in the kitchens.

- Updates to electrical and plumbing fixtures as needed

Exterior improvements will involve:

- Fresh exterior paint for the buildings

- Attractive landscaping redesign

- New signage, wayfinding systems, and rebranding

- Expanded exterior lighting

- Roof renovation, including the installation of insulation.

- Replacement of damaged wall coverings

- Enhancements to the clubhouse, fitness center, and laundry room

A budget of 1.1 million USD has been allocated for these improvements. Upon completion, we anticipate a property value increase of approximately 4.7 million USD.

Interior ceiling collapse and insulation debris following roof failure

Exposed roof structure following storm-related material loss

Fallen tree obstructing primary walkway access to building

Roofing crews applying new TPO membrane to restore waterproofing and structural integrity

Operational Update – Hurricane Milton Impact

On October 9, 2024, Hurricane Milton made landfall on Florida’s west coast, causing relevant damage across the Tampa Bay region. Atlas at Bay Point was significantly impacted, but we are grateful that all residents and staff remained safe.

In advance of the storm, we activated our Emergency Response & Hurricane Protocol, which included securing loose items, boarding up facilities, notifying residents of evacuation zones, and pre-coordinating with emergency contractors and insurance adjusters. Thanks to these preparations, we were able to respond quickly once the storm passed.

Emergency Preparedness Efforts

Damage Assessment

- Notified residents about storm forecasts and evacuation zones.

- Secured trash bins, pool furniture, and outdoor equipment.

- Boarded up the leasing office and critical areas.

- Cleared storm drains and trimmed trees.

- Pre-alerted insurance brokers, carriers, and adjusters.

- Arranged roofing contractors and emergency responders to be on standby.

- Closed the leasing office in a timely manner to ensure staff and resident safety.

These efforts minimized the risk to tenants and set the stage for a faster recovery.

- Multiple fallen trees, including one large tree leaning against a building.

- Extensive roof damage; drone inspections revealed three buildings with major roofing loss.

- Debris scattered across the property.

- Interior damage rendered at least 10 units immediately uninhabitable.

Insurance and Recovery Strategy

We have submitted a complete Business Loss Income Insurance claim covering operational disruptions through March 31st. Advance payments from our insurance carrier are expected shortly, ensuring continuity during the recovery phase. Our team is working closely with the public adjuster’s CPA to document lost rental income, repair costs, utilities, and associated expenses.

Insurance coverage is expected to compensate for lost rents up to 92% occupancy for up to two years, providing strong financial protection during the rebuilding process.

Leasing and Occupancy Performance

- 224 leasing inquiries were received in March.

- 94% occupancy was maintained on available units.

- 3 lease renewals completed in March, with a 7.1% rent increase annualized.

- In-place rents have grown 4.2% since acquisition, exceeding projections.

Our AI leasing assistant, “Lisa”, has further streamlined leasing efforts, handling tenant inquiries and scheduling tours effectively, maintaining strong lead conversion despite adverse conditions.

Capital Improvement Opportunity

While the hurricane damage is unfortunate, it presents a unique opportunity for property enhancement:

- Replacement of multiple roofs will strengthen the asset’s long-term value.

- Several affected units were already scheduled for renovation; insurance-supported repairs will allow for more efficient upgrades.

- Exterior work will include repainting and landscaping to boost curb appeal.

This reconstruction phase will allow Atlas at Bay Point to emerge stronger, safer, and even more attractive to tenants.

Recovery in Action

Reconstruction is already underway:

- Roofers have secured all critical sections.

- Interior remediation teams are operating on-site.

- Cleanup and stabilization efforts continue daily.

Commitment to Investors

We will continue to provide weekly updates as recovery progresses. Thanks to robust insurance coverage and disciplined asset management, Atlas at Bay Point remains well positioned for full stabilization. We are confident that these efforts will lead not only to full restoration, but to an even stronger asset for the long term.

Results to Date

Initial Project Steps

Since acquiring the property in June/July 2024, we have been in the early stages of familiarizing ourselves with the project. One of the first steps we took was establishing the new name and launching a corresponding website.

This creates a solid foundation for branding and communication with prospective tenants and stakeholders.

Model Unit

Additionally, we immediately renovated, furnished, and designed a model unit as a prototype for the future renovations of all units.

This show apartment allows prospective tenants to get a tangible sense of the quality of the finishes, the layout, and the overall living experience. By creating an emotional connection, we help visitors envision themselves living in the space while offering suggestions for optimal room utilization.

Looking Ahead with Confidence

We are now looking forward to the next five years with both enthusiasm and calm determination. This project holds special significance for us as it demonstrates that Whitestone Capital has matured: we are surrounded by well-capitalized investors who trust in our capabilities.

We can apply the skills we have honed over nearly a decade in an environment free from the pressures of urgency.

Commitment to Long-Term Success

Our focus remains on what defines Whitestone Capital—measured professionalism and the execution of long-term, forward-thinking strategies.

We approach the project with confidence, knowing that our calm and calculated approach will deliver sustained value over time.

We will keep you posted

We will continue to keep you informed as we progress through this exciting project!

West River Flats

ADDRESS | PURCHASE DATE | SALE DATE | AVG. RENT AT PURCHASE |

|---|---|---|---|

AVG. RENT AT SALE | RENT INCREASE | NOI | IRR REALIZED |

|---|---|---|---|

Past performance and statements regarding earnings are no guarantee of future results.

At a glance

Purchase Date | |

Sale Date | |

Avg. rent at purchase | |

Avg. rent at sale | |

Rent increase | |

NOI | |

IRR realized |

Why we invested

West River Flats challenged us on even different levels than other projects. Intrigued by the relatively good state of the 135 apartments, we had to deal with a few situations uncommon to our usual work.

Opportunities and challenges

- Being conceived during the COVID crisis, it became troublesome to meet lenders in person and secure financing.

- The previous owner had maintained a relatively high state of renovation. Kitchens were mostly renewed, had black appliances, granite countertops, shaker cabinets, tile flooring, and shiplap siding.

- Regarding rent-increasing amenities, a swimming pool put West River Flats well above average.

- While the treatment of the premises was rather diligent, the administration lacked discipline and sustainability. We found a significant amount of back rents as well as unoccupied apartments.

- It became obvious that marketing and management would be crucial to success here, where usually building measures are needed in advance to release a project’s potential.

Results

Although circumstances were unusual, we managed to acquire West River Flats in November of 2020.

Aside from our regular activities to improve the premises as a whole, we set our focus on marketing the vacant apartments since their state was flawless.

After circa six months, every single apartment was rented out, already improving the cash flow greatly while several apartments were renovated in a higher standard.

Further Improvements like the remodeling of the exterior walls along with considerate management allowed us to increase rent for current tenants, further improving revenues.

Our effective and enduring improvements lifted revenue expectations greatly, thus enabling us to yield a greatly increased sales price. In a short 18 months, the asset exceeded the proforma estimates and the property was listed for sale well ahead of schedule.

Sabal Palm Portfolio

ADDRESS | PURCHASE DATE | SALE DATE | AVG. RENT AT PURCHASE |

|---|---|---|---|

AVG. RENT AT SALE | RENT INCREASE | NOI | IRR REALIZED |

|---|---|---|---|

Past performance and statements regarding earnings are no guarantee of future results.

At a glance

Purchase Date | |

Sale Date | |

Avg. rent at purchase | |

Avg. rent at sale | |

Rent increase | |

NOI | |

IRR realized |

Why we invested

The Sabal Palm Portfolio with its 127 apartments was one of our larger projects, consisting of seven separate properties located along 4th Street South, distributed over a quarter mile.

The opportunities of this project were striking but not easy to implement.

Opportunities and challenges

- As it is often the case with opportunities, they come as a blessing in disguise, meaning the premises and apartments were gravely neglected.

- As a consequence of mismanagement, a noteworthy number of residents had started to withhold rent payments.

- A fraction of the apartments were already untenable.

- The community was demoralized with police being present almost daily and may tenants had given up on it as well as prior management.

- Still, we were aware that the ensemble was very close to bustling Downtown St. Petersburg with many attractive places of work.

- Since the entire package represented 75% of the neighborhood, we felt optimistic to make a real change.

Results

During our previous projects we had recruited our own team of craftspeople instead of relying on third party contractors, giving us the manpower a project like this needed.

Once again we commenced the renovation of dozens of apartments while sorting out which tenants to keep and which could not be kept any longer.

Our investors were not the first to appreciate our work as only two months into the project, local police forces visited our property manager to state the drastic reduction of police operation on the premises.

Within 17 months, the majority of the apartments were renovated. Almost every facade was refaced and various roofs exchanged.

Aside from impressive returns and satisfied investors we were once more able to keep our promise to leave an intact and viable quarter to hundreds of people in the heart of St. Petersburg.

Altura Largo

ADDRESS | PURCHASE DATE | SALE DATE | AVG. RENT AT PURCHASE |

|---|---|---|---|

AVG. RENT AT SALE | RENT INCREASE | NOI | IRR REALIZED |

|---|---|---|---|

Past performance and statements regarding earnings are no guarantee of future results.

At a glance

Purchase Date | |

Sale Date | |

Avg. rent at purchase | |

Avg. rent at sale | |

Rent increase | |

NOI | |

IRR realized |

Why we invested

Altura Largo, consisting of 232 flats had an intriguing past. The previous owner intended to merge the condominiums and convert it into a single property in order to resell it.

After having bought the majority of the apartments already, the investor acquired more and more condominiums from their respective owners.

Opportunities and challenges

- Solely focused on the idea of creating an easy fungible package of condominiums, maintenance was not taken care of. 838 complaint tickets were unprocessed.

- Consistently, not only the interior of the apartments lacked maintenance, the entire premises needed substantial renovation.

- We found several obvious improvements which would lift the overall appearance of the estate.

- As in almost every project, communication with the tenants was crucial in order to clear doubts in the new management and to cement new hope.

Results

During the first three weeks, we took great effort in addressing the many complaints, order them by priority and send in our maintenance technicians.

We had to replace more than 40% of the roofs. After having dealt with these pressing matters, the facades were renewed and new balustrades and blinds were installed on the balconies. During the first year, the majority of the apartments were completely redone.

The bathrooms received water saving toilets and armatures to save water as well as running costs.

The maintenance office was also refurbished in its entirety to create a contact point for our tenants.

Later we laid our attention to energy savings by replacing all windows with modern and energy efficient windows.

A fitness center for the tenants is due to be opened in early 2023.

We are very proud to have proven that we were able to manage a project with more than 200 tenants and apartments once given the chance. The realized rent increases is as satisfying as the many pleased people living at Altura Largo.

Madison at 4th

ADDRESS | PURCHASE DATE | SALE DATE | AVG. RENT AT PURCHASE |

|---|---|---|---|

AVG. RENT AT SALE | RENT INCREASE | NOI | IRR REALIZED |

|---|---|---|---|

Past performance and statements regarding earnings are no guarantee of future results.

At a glance

Purchase Date | |

Sale Date | |

Avg. rent at purchase | |

Avg. rent at sale | |

Rent increase | |

NOI | |

IRR realized |

Why we invested

“Madison at Fourth” comprising of 21 apartments was Whitestone’s second project. While we are primarily focused on great investments to create great homes, in this project we also relieved an overburdened owner.

Opportunities and challenges

- The premises had not been maintained for a long period of time. The decay was so advanced that some apartments could not even be rented out anymore.

- The present tenants were left discouraged and frustrated by their former landlord, thus treating the premises with little respect also.

- Because of the lax management, payment practice had also lowered over time, burdening the low cash flow even more, giving us the opportunity to part ways with conflicting tenants.

- The owner was ready to sell the premises on progress payment with an owner financing, allowing us to only refinance a fraction of the asking price, recouping the unpaid balance while and by improving the housing estate.

- Our analysis conducted that severe investing would be needed to renovate the building’s face and roof as well as the apartments themselves but that the estimated rent increases would outweigh these investments by far.

Results

After becoming familiar with the tenants, we were able to establish our common goal to create a better place to live for everyone involved and embarked the voyage to a “new Madison” together.

The facade was renewed and the roofs were rebuilt in their entirety.

We also renovated every single inhabited and vacant apartment within a few months, thus assuring that renting out could start as early as possible. That was another opportunity to proof to ourselves our ability to act very quickly whenever needed.

We also installed a new fire alarm system in increase the overall feeling of safety.

We and our investors were very pleased with our results in rent increases as well as the sale price two years after our acquisition. This encouraged us further to apply our concept to more and larger projects.

Wildwood Way Villas

ADDRESS | PURCHASE DATE | SALE DATE | AVG. RENT AT PURCHASE |

|---|---|---|---|

AVG. RENT AT SALE | RENT INCREASE | NOI | IRR REALIZED |

|---|---|---|---|

Past performance and statements regarding earnings are no guarantee of future results.

At a glance

Purchase Date | |

Sale Date | |

Avg. rent at purchase | |

Avg. rent at sale | |

Rent increase | |

NOI | |

IRR realized |

Why we invested

“Wildwood” was Whitestone Capital’s first endeavor. We saw an immense potential for rent increases the previous owners neglected.

Wildwood way was the perfect ground for our company to proof our concept to ourselves and our first investors.

Opportunities and challenges

- The premises were in a rather good condition that did not require substantial renovation. In fact, we were surprised the property was for sale – its potential seemed almost too obvious.

- When interviewing the tenants we sensed tensions with some of the residents which was troubling and needed attention. Our managers had to mediate some conflicts, showing and challenging our social skills.

- Some of the apartments had not been renovated in a long time, giving us the chance to offer renovation against an increased rent.

- We found several obvious improvements which would lift the overall appearance of the housing estate.

Results

We immediately took care of the tenant management. We held meetings with tenants as well as in groups as face to face. Our professional yet friendly appearance helped to restore an agreeable atmosphere for everybody.

This did not keep us from evicting a small number of tenants who were notoriously disturbing the peace.

Whenever lessees did not continue their contract with us, we took the opportunity to renovate the respective apartment, setting a new standard for Wildwood Way.

We also reconstructed the entire roofing, installed an attractive outdoor lighting as well as a video surveillance system for everyone’s safety and peace of mind.

Within about 40 months, we were able to hand over a well run apartment complex to a grateful buyer, paying a markup of 26%, proving the “Whitestone way” is a success and giving us the first entry in our track record.